The wait times are supposed to be two minutes, which the CRA meets about 81 per cent of the time, according to the figures tabled in response to an order paper question from Liberal MP Ralph Goodale. At that rate, by the end of this fiscal year 59.6 million calls to the CRA won’t be connected right away - or at least be put in the queue to speak to an official. The data show that of the 12.8 million calls between March 30 and the most recent figures available - a busy signal greeted almost four in every five calls. So far this fiscal year, things have gotten worse. When the system is at capacity, callers hear a busy signal, forcing them to make multiple calls.

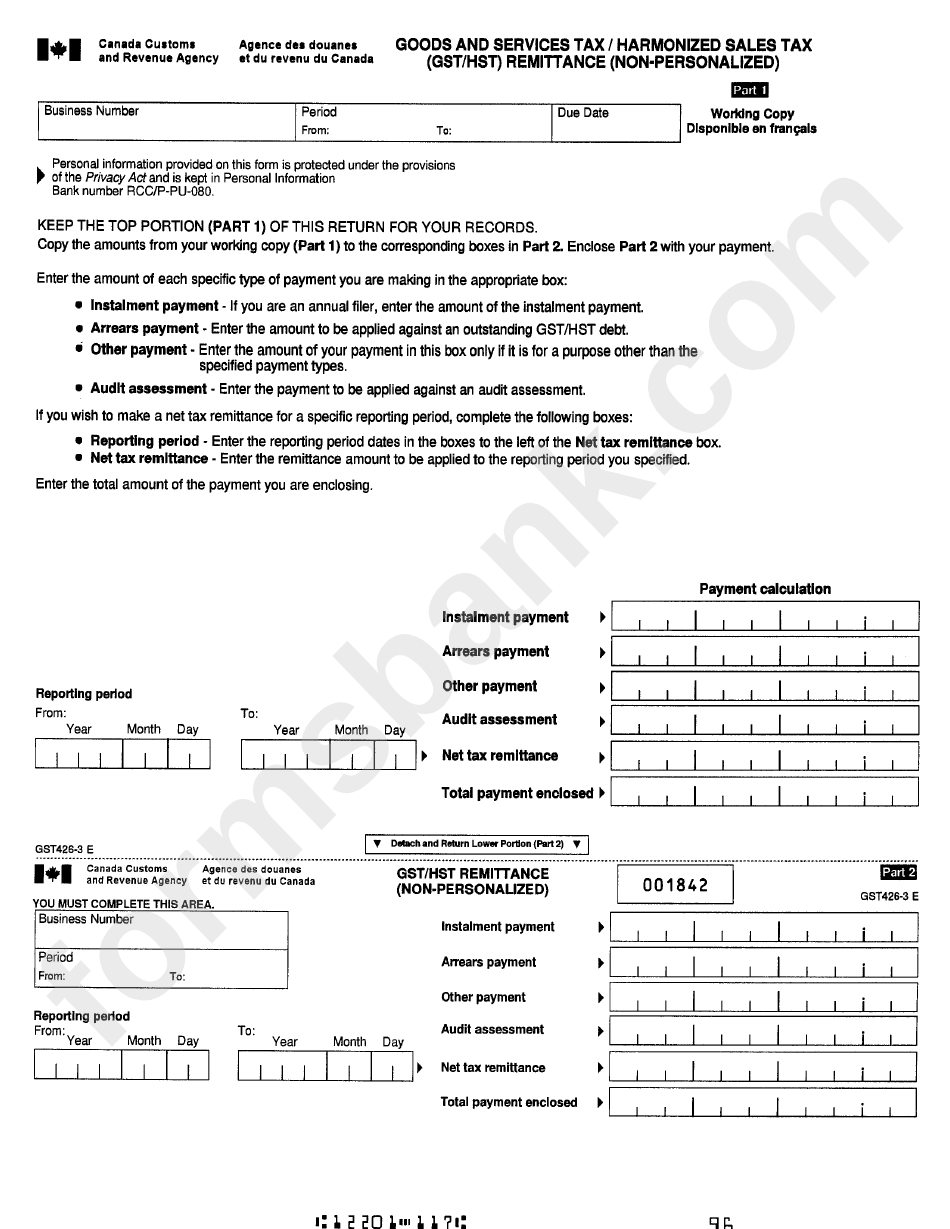

The CRA’s phone system doesn’t allow every call into the system. The remaining two-thirds, or 40.9 million calls, got a busy signal. * operates a toll free information line for nonprofit agencies and Canadian amateur athletic organizations regarding licensing guidelines, concerning their application for charitable status.OTTAWA-Almost seven in every 10 callers looking for help from the Canada Revenue Agency are greeted by a busy signal because the lines are overwhelmed, newly released documents show.įigures tabled in Parliament this week show that in the 2014-15 fiscal year, about one-third of the 60.1 million calls made to the tax agency went through on the first try. interpretations where the law needs clarification * advises the public of their rights and obligations under the Canadian Income Tax System and Excise Tax Act * provides information and answers questions on the proper completion of income tax and G.S.T.

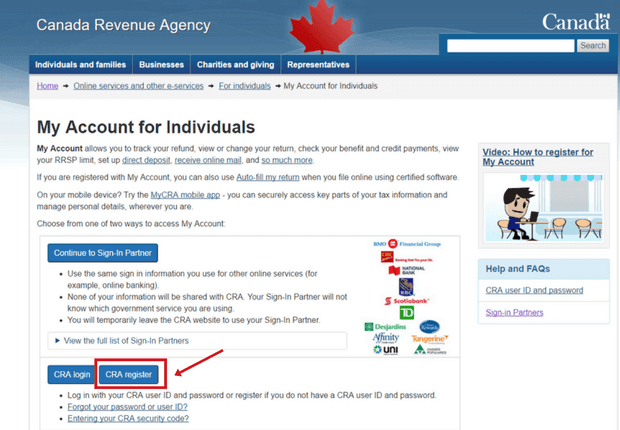

(Automatic Tax Info Phone Services) Inquiries 1-80 (English) 1-80 (French) Refund Inquiries 1-80 (English) 1-80 (French) Payment Arrangements Inquiries 1-88 (English) 1-88 (French) If you are having trouble using the GST/HST Registry, call the Canada Revenue Agency's Business enquiries line at 1-80. Service Description General Inquiries 1-80 (English) 1-80 (French) īusiness and Self Employed Individuals Inquiries 1-80 (English) 1-80 (French)Ĭanada Child Benefit, Goods and Services Tax (GST) Credit Inquiries 1-80 (English), 1-80 (French) Use the GST payments RC159/RC160 option to pay amounts owed after Canada Revenue Agency assesses/reassesses a filed return or to make instalment payments.

0 kommentar(er)

0 kommentar(er)